In the non-profit sector, managing funds is a delicate balancing act, especially regarding payroll. Donor restrictions can add a layer of complexity to this process. This article sheds light on the challenges non-profits face due to donor-imposed restrictions on funds and how these impact payroll management. We will provide practical advice for financial officers, CEOs, fundraisers, board members, and compliance officers in non-profits to navigate these restrictions effectively.

The Challenge of Donor-Imposed Restrictions

Donor-imposed restrictions can significantly impact how non-profits manage their finances, especially payroll. These restrictions often specify how funds can be used, limiting the organization's flexibility in allocating resources for operational expenses like payroll. This can create a challenging situation for non-profits, as they must balance donor wishes with organizational needs.

Navigating Payroll Management under Restrictions

Effective payroll management in the context of donor restrictions requires a strategic approach. Non-profits must develop robust financial systems that track and manage restricted funds accurately. This includes establishing clear delineations between restricted and unrestricted funds and ensuring that payroll expenses are appropriately categorized.

Ensuring Compliance and Transparency

Compliance is key in managing restricted funds. Non-profits must adhere to the specific stipulations set by donors, which requires an in-depth understanding of these restrictions and a transparent approach to financial reporting. Non-profits need to communicate effectively with donors and board members about their payroll needs and the limitations imposed by restricted funds. This transparency fosters trust and can lead to more flexible funding arrangements.

Practical Insights for Non-Profits

- Detailed Record-Keeping: Prioritize systematic documentation of all donor restrictions. Incorporate these details into payroll management to ensure compliance and avoid financial missteps. Regular audits are essential for maintaining accuracy.

- Financial Planning: Develop a financial strategy that aligns payroll needs with the availability of restricted and unrestricted funds. Anticipate cash flow variations and plan accordingly to maintain operational stability.

- Communication: Maintain open communication with donors and board members about payroll challenges. Transparent discussions can lead to renegotiating restrictions and better understanding of the organization's financial needs.

- Technology Utilization: Invest in specialized payroll management tools capable of handling the nuances of restricted and unrestricted funds. Automation and integration with financial systems can improve efficiency and accuracy in fund allocation.

Payday Payroll's Give Back Program

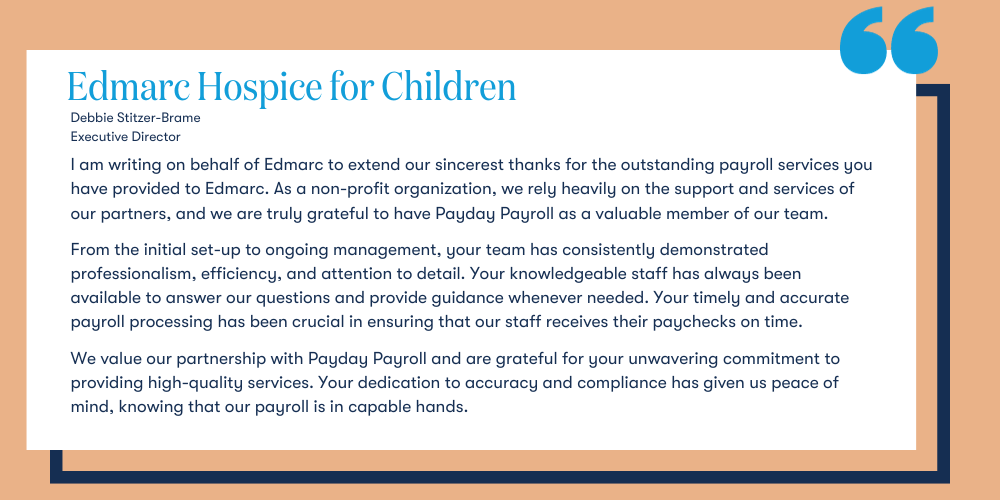

At Payday Payroll, our dedication to community support goes beyond providing exceptional payroll services. Central to this commitment is the Payday's Give Back Program, where we donate 10% of the annual payroll invoice amount, back to our non-profit partners.

For non-profits partnering with Payday Payroll, this program offers more than just payroll solutions; it represents our promise to invest in their success and growth. We believe that real success is achieved when we support and uplift each other, creating a more vibrant and resilient community for everyone.

Get Efficient Payroll Management Help Today

Understanding and managing donor-imposed restrictions on payroll is a crucial aspect of non-profit financial management. By employing effective strategies and maintaining transparent communication, non-profits can navigate these challenges while remaining compliant and operationally efficient.

If you're facing difficulties with donor restrictions in payroll management, contact Payday Payroll for specialized guidance and solutions tailored to your non-profit's needs.