In the heart of every non-profit organization lies a mission driven by passion and dedication. However, managing the financial aspects, especially payroll, can often be challenging. With the advancement of technology, non-profit leaders, financial managers, IT professionals, and decision-makers have the opportunity to transform their payroll systems. This guide aims to introduce advanced, cost-effective payroll technologies specifically designed for the non-profit sector.

The Need for Advanced Payroll Solutions in Non-Profits

Non-profit organizations often operate with limited resources and under tight budget constraints. Traditional payroll systems can be time-consuming, prone to errors, and costly in the long run. Adopting modern payroll solutions, particularly cloud-based systems, automated reporting, and integrated accounting tools, can be a game-changer. These technologies not only streamline payroll processes but also ensure accuracy and compliance with regulatory requirements.

Benefits of Cloud-Based Payroll for Non-Profits

Cloud-based payroll solutions offer unparalleled flexibility and scalability, essential for non-profits that often have fluctuating staffing needs. These systems provide secure, remote access to payroll data, making it easier to manage payroll from any location. Additionally, cloud-based solutions reduce the need for in-house IT maintenance, thus saving costs and resources.

Automated Payroll Reporting and Integration Capabilities

Automation in payroll reporting dramatically reduces the time and effort involved in processing payroll. It minimizes errors and ensures employees are paid accurately and on time. Furthermore, integrating payroll systems with non-profit accounting software offers a holistic view of the organization's finances, enabling better budgeting and financial planning.

Making the Switch: Considerations for Non-Profits

While the benefits are clear, transitioning to a new payroll system requires careful consideration. Non-profits must assess their specific needs, budget constraints, and the level of support required for implementation. It's crucial to choose a solution that is not only cost-effective but also aligns with the organization's size and complexity.

Payday Payroll's Give Back Program

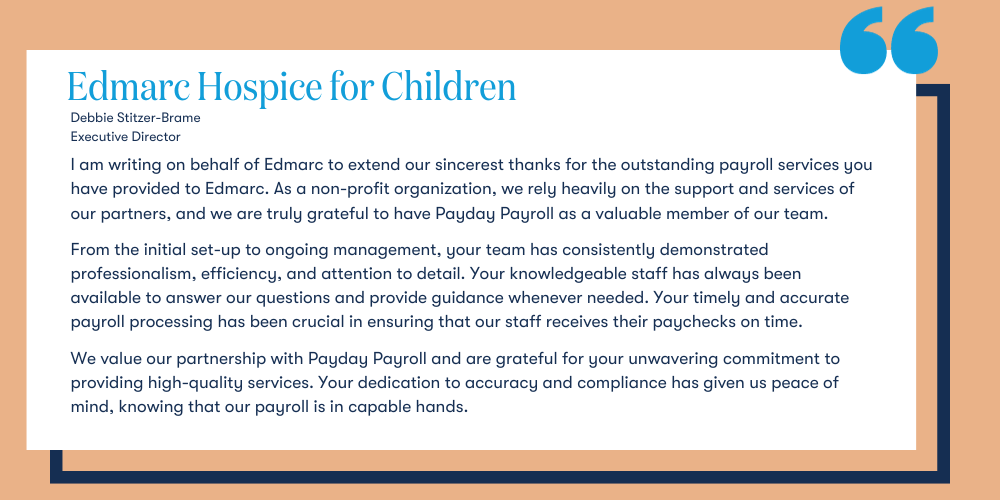

At Payday Payroll, our dedication to community support goes beyond providing exceptional payroll services. Central to this commitment is the Payday's Give Back Program, where we donate 10% of the annual payroll invoice amount, back to our non-profit partners.

For non-profits partnering with Payday Payroll, this program offers more than just payroll solutions; it represents our promise to invest in their success and growth. We believe that real success is achieved when we support and uplift each other, creating a more vibrant and resilient community for everyone.

Tailored Options to Increase Your Efficiency

Adopting advanced payroll technologies is not a luxury but a strategic decision for non-profits. It leads to improved efficiency, accuracy, and financial health. If you're ready to streamline your non-profit's payroll, explore Payday Payroll's tailored solutions. Contact us to learn more and embark on a journey towards efficient, error-free payroll management.